Imagine cruising through city streets on your electric bike, the wind in your hair, and the world at your feet. But what happens if the unexpected strikes? From theft to accidents, safeguarding your e-bike is crucial.

Welcome to our comprehensive guide on electric bike insurance—a must-read for every e-bike enthusiast.

Discover how the right coverage can keep your two-wheeled companion safe and your mind at ease. Let’s dive into the maze of e-bike insurance and ensure your ride remains worry-free!

Understanding E-Bike Insurance

Trying to figure out electric bike insurance is like riding through a maze—it can be tricky, but man, is it important! That two-wheeled buddy of yours deserves all the protection it can get, after all. Let’s get into why you might want to consider e-bike insurance.

Importance of E-Bike Insurance

First off, electric bikes are in a league of their own when it comes to what coverage they need. The usual home or auto insurance doesn’t quite cut it for these zippy machines, so grabbing e-bike insurance is pretty much a safety net every rider should have.

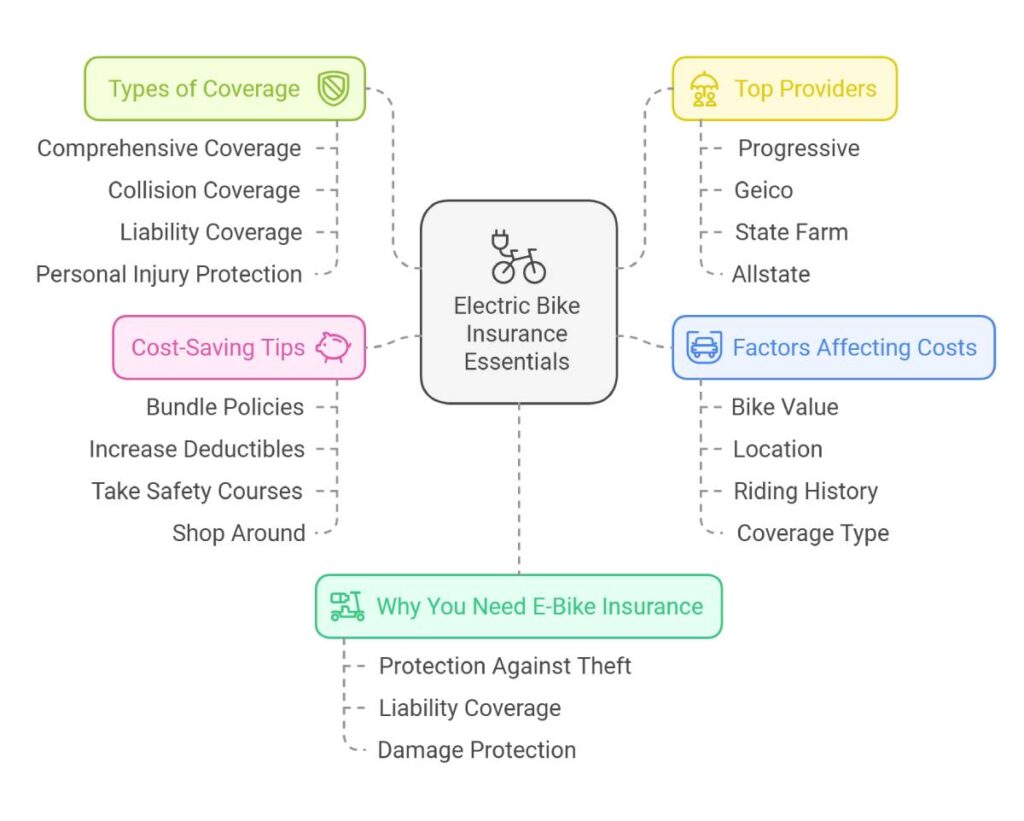

Here’s why e-bike insurance should be a no-brainer:

- Accident Coverage: It’s like a helmet for your wallet—keeps you covered if you bang up your ride.

- Theft Protection: If someone makes off with your beloved bike, insurance swoops in to help save the day. This is super important for folks biking around cities or working delivery.

- Liability Protection: Keeps you in the clear if you accidentally cause someone else harm or damage, so you’re not emptying your pockets for legal stuff.

Cars hog up most insurance attention, leaving little for e-bikes, which is why having coverage matters even more.

Benefits of E-Bike Insurance

E-bike insurance comes with a basket full of perks for different types of riders, whether you’re a tree hugger on wheels, an older adult getting back in the game, or a fitness buff.

- Comprehensive Coverage: Covers a lot of ground—think beyond what your house policy handles, like theft when you’re out and about, crashes, boo-boos, and even when you’re pedaling across the border.

- Peace of Mind: Some policies offer low deductibles so fixing or replacing your bike doesn’t clean out your savings after a mishap.

- Tailored Protection: You can tweak insurance to fit your lifestyle—like coverage for damage while traveling or getting into scrapes during a race.

- Legal Compliance: While not yet a law everywhere, having insurance means you’re ready if and when states decide to make it a requirement (Progressive).

- Full Value Coverage: Some insurers, like Velosurance, offer policies that won’t skimp out if something happens—they’ll cover the entire worth of your bike without knocking off value for wear and tear.

Why You Need It

All in all, e-bike insurance isn’t just about having your bike’s backside covered; it also offers you protection and calm. Understanding the options available out there can help you snag just the right coverage for how and where you ride. For tips on taking good care of your e-bike, check out our neat guide on electric bike maintenance.

Coverage Options

Thinking about insurance for your e-bike? You gotta know what you’re getting into. Insurance isn’t just for bad drivers; it’s your safety net for those unexpected surprises that make your wallet cry. Let’s break down the types of coverage you’ll want to check out:

Liability Coverage

Do you know that little voice in your head? Let’s call it Uncle Sam. Uncle Sam wants you to have liability coverage—because just in case your e-bike joyride goes sideways and someone else gets hurt or their stuff gets wrecked, you could be on the hook. Most car insurance gives you zip for e-bikes, so think of this more like a necessity than a luxury.

| Coverage Option | What’s in the Bag | Who’s Got Your Back |

|---|---|---|

| Liability Coverage | Sorting out injuries to others or their property | BikeInsure, Velosurance |

Property Damage Coverage

Picture this: your e-bike, target practice for a pigeon, or caught in a surprise hailstorm. Property damage coverage steps in to cover those mishaps and more, protecting your cherished ride from a smorgasbord of potential mishaps, be it an unfortunate bump, an ill-intentioned act, or Mother Nature’s bad mood.

For instance, Velosurance steps up to the plate with coverage for anything from accidental oopsies to crash monstrosities, and even those inevitable travel dings whether you’re pedaling away or someone else is borrowing your wheels with a friendly nod.

| Coverage Option | What It’s Got | Who’s Got You Covered |

|---|---|---|

| Property Damage | Accidents, crashes, travel misadventures | Velosurance, BikeInsure |

Theft and Vandalism Coverage

Seems like bikes can be quite the tempting loot these days. Theft and vandalism coverage is your knight in shining armor when someone snatches your e-bike or it falls victim to a graffiti spree.

For just $8 a month, BikeInsure gets your back with Bicycle Theft Insurance, ensuring you’re not throwing a farewell party for that bike of yours without a solid backup plan (BikeInsure). And if you’re cruising with Velosurance, they promise full value coverage, making sure you get the whole shebang without feeling the depreciating blues.

| Coverage Option | Coverage Deets | Who’s on the Case |

|---|---|---|

| Theft and Vandalism | Yoinked bikes, artistic vandals | BikeInsure, Velosurance |

Now that you’re in the know about these coverage options, you have the power to make a smart choice when picking an insurance sidekick for your e-bike. If you’re hungry for more wisdom on keeping your two-wheeled wonder safe, check out our nuggets on electric bike security and tips for storing your electric bike.

Factors Affecting Insurance Costs

Value of the E-Bike

The price tag on your e-bike isn’t just for bragging rights; it’s a big deal for insurance too. More expensive bikes mean your premiums will be more “ouch” than “woohoo.” Think about it this way: Covering a $3,000 e-bike might run you about $100 a year. But if you’re zooming around on a $9,000 beauty, you’re looking at paying a lot more to keep it insured.

Location Impact

Where you park your bike can make a wallet-sized difference too. City folk in places like New York or San Francisco, where your bike might mysteriously grow wings, usually pay more. Insuring a $6,000 e-bike in such a bustling city could empty your pockets by about $270 every year. Meanwhile, in easy-going small towns, you’d fork out around $125 annually for a $2,100 e-bike.

| Location | E-Bike Value | Annual Premium |

|---|---|---|

| Urban Area (Large) | $6,000 | $270 |

| Small Town | $2,100 | $125 |

Type of Coverage Chosen

What you want to cover changes the price too. Basic plans cover theft or damage, leaving some change in your pocket. But if you’re adding covers like liability or splurging on medical, expect to shell out more. Medical extras could bump your annual costs by $78, and roadside assistance might squeeze out another $9.24.

Deductible Amount

Choosing a deductible is like picking your poison—what do you want to pay now vs. later? Go high with a $200 deductible, and your premiums stay low. But choose $100, and your monthly bill goes up. Either way, you decide how much to cough up if you ever need to file a claim.

Getting your head around these facts can prepare you for picking the right electric bike insurance. If you’re curious about keeping your ride smooth and secure, hop over to our tips on electric bike maintenance and electric bike security.

Popular E-Bike Insurance Providers

When it comes to protecting your electric bike, you’ve got some solid options to make sure your ride’s safe from whatever life throws at it. Here’s the lowdown on five standout e-bike insurance providers that’ll keep your wheels rolling smoothly:

BikeInsure

BikeInsure’s your go-to if you’re after bicycle-specific coverage, and yep, that includes electric bikes. They’ve got you covered with plans that’ll take care of theft, getting roughed up, or those “oops” moments. You can tweak plans to fit your needs, so you’re covered no matter what your bike adventures throw at you.

Coverage Highlights:

- Theft and Vandalism

- Accident Damage

- Liability Protection

Check out our tips for more ways to keep your e-bike secure.

Velosurance

Velosurance knows bikes inside and out, and they’ve got the plans to prove it. Whether you’re worried about theft, damage, or liability, they’ve teamed up with big insurers to get you both great rates and peace of mind.

Coverage Options:

- All-Theft Coverage

- Accident Damage

- Third-Party Liability

Peek at our battery care guide for ways to keep your battery buzzing.

Markel

Markel’s no newbie in the insurance game. Their e-bike policies offer a solid shield against theft and accidents, and they won’t leave you in the lurch when it comes to liability. They also cover medical costs if things go south.

Key Coverages:

- Theft and Liability

- Collision Damage

- Medical Expenses

Get our bike maintenance tips to keep your e-bike tip-top.

Spoke

Spoke’s got your back, whether you’re a chill cruiser or biking beast. They’ve got plans to tackle theft, damage, and liabilities like a charm. With their easy service, securing coverage is a no-brainer.

Coverage Includes:

- Theft and Misery

- Accident Damage

- Liability Shield

Curious about maximizing your e-bike’s journey distance? Check out our range tips.

Progressive

Progressive isn’t just about cars—they’ve expanded their expertise to e-bikes, offering solid defenses against theft and damage. Their wide reach and know-how make them a trusted name in the biz.

Coverage Features:

- Theft and Vandalism

- Collision Damage

- Liability Coverage

If a DIY vibe is your style, explore our conversion guide.

| Provider | Theft Coverage | Damage Coverage | Liability Protection |

|---|---|---|---|

| BikeInsure | Yes | Yes | Yes |

| Velosurance | Yes | Yes | Yes |

| Markel | Yes | Yes | Yes |

| Spoke | Yes | Yes | Yes |

| Progressive | Yes | Yes | Yes |

By weighing up these options, you’ll find the coverage that fits your e-bike lifestyle just right. For more on owning an electric bike, including charging tips and maintenance help, have a look at what else we’ve got to share.

Regulations and Requirements

State-by-State Regulations

Let’s dive into the wild world of electric bike rules. Each state has its own quirks, sort of like the way we all have that one family member who brings a mystery dish to the holiday potluck. Most places just treat e-bikes like regular bicycles, meaning no extra insurance, licensing, or hoops to jump through. But hold on—knowing your state’s specific quirks is key for riding without any legal hiccups.

Here’s a quick glance at how the e-bike game changes state by state:

| State | Classification | Licensing/Registration | Recommended Insurance |

|---|---|---|---|

| California | Class 1, 2, and 3 e-bikes fit right in with bikes | Nope | Yes |

| New York | Class 1 and 2 slide by as bicycles; Class 3 needs a bit more formality | Class 3 only | Yes |

| Texas | Two wheels just like bicycles | Nah | Yes |

| Florida | Keep pedaling like a bicycle pro | Nope | Yes |

| Washington | Class 1, 2, and 3 ride the bike wave | No | Yes |

| Massachusetts | Gets fancy—treats e-bikes like mopeds, so registration and a license are in play | Yep | Yes |

Do you have some burning questions? Dive into our juicy details in electric bike laws.

Mandatory Insurance States

Most states won’t twist your arm about e-bike insurance, but, you know, it’s worth mulling over. Turns out, your homeowner’s or renter’s insurance just might look the other way, especially on those liability and medical bits. And if you’re rolling through Massachusetts with your e-bike-moped hybrid, prepare for some paperwork and liability fun.

Insuring your e-bike can bring a little peace, like that first sip of steaming coffee on a Monday morning. Here’s a cheat sheet of folks who’ll have your back:

- BikeInsure: Comforts you with all-around e-bike protection.

- Velosurance: Has your back with coverage for bumps, theft, and those oops! moments with the option of liability.

- Markel: Offers a safety net for physical injury, theft, and a few more surprises.

For the nitty-gritty on costs, pop over to our section on Factors Affecting Insurance Costs.

Knowing your state’s e-bike script is like having a GPS for your ride. Plus, considering insurance can keep you cruising confidently without the “what ifs” getting in the way. For the scoop on keeping your e-bike safe and sound, peek at our electric bike security articles, and set your wheels rolling!

Comprehensive Coverage Details

Picking out the right insurance for your e-bike isn’t just about numbers and plans. It’s about making sure your wheels are safe from a long list of potential mishaps. This way, whether you’re zipping through city streets or being your eco-friendly self, you’ll feel relaxed knowing your bike’s got protection.

Detailed Coverage Inclusions

Not all insurance packages are created equal. Here’s a look at what many of them offer:

- Ding and Dent Coverage: If you accidentally collide with a pole, or worse, another biker.

- Gotcha Coverage: If your pride and joy disappear, stolen under the shadow of night.

- Mischief Management: Covers repairs if someone vandalizes your bike.

- Extra Bits and Bobs: Keeps tags on those extra gadgets you bolted onto your bike.

- Traveling Scratches: If your bike gets damaged en route via car or airplane.

- International Shield: Protection even if you’re halfway around the globe.

- Depreciation? What’s That?: Insurers that dish out the initial value when things go south, skipping depreciation.

Velosurance, for instance, offers complete protection without slicing the value for depreciation. It covers the verified worth of the bike and its extras, safeguarding both partial and total losses. Similarly, Markel throws in physical damage insurance, spare parts safeguarding, and even international reach.

| Provider | Price | Ding & Dent | Gotcha Coverage | Mischief Management | Extra Bits & Bobs | Traveling Scratches | International Shield | Depreciation-Free |

|---|---|---|---|---|---|---|---|---|

| BikeInsure | $16.99/month | Yes | Yes | Yes | Yes | Yes | No | No |

| Velosurance | Custom | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Markel | $100/year | Yes | Yes | Yes | Yes | Yes | Yes | No |

Exclusions and Limitations

It’s not all sunshine and rainbows, though. Comprehensive plans have some “no-go” zones:

- Everyday Wears: The usual grind and wear aren’t often covered.

- Bicycle Blues: Breakdowns from poor maintenance? Don’t count on it.

- X Games Shenanigans: Thrill-seekers and racers may find themselves uncovered.

- Old News Flaws: Pre-existing problems before buying the plan are off the table.

- Unauthorized Joyride: If a non-insured buddy takes your bike for a spin and it ends poorly, it’s a no.

- Unlocked and Unlucky: Theft might not be covered if the bike wasn’t properly secured.

Consider, for example, BikeInsure’s theft coverage, which spans a $10,000 annual cap for damages and theft, but be wary—it doesn’t consider bikes left unsecured.

Understanding these bits beforehand can help you land the perfect fit for your insurance peace of mind. For smart tips on keeping your ride safe and snug, check out our guides on electric bike security and storing electric bikes.

Cost-Saving Tips

Bundling Policies

Who doesn’t love a good bundle? One smart trick to cut down on your electric bike insurance is bundling multiple policies together. Some big-name insurers, like Progressive, let you toss bike insurance into the mix with your homeowners, renters, or condo plans, often throwing a discount your way. It’s like getting a combo meal from your favorite fast-food joint, but way more practical.

| Insurance Provider | Potential Savings |

|---|---|

| Progressive | Multi-policy discount |

Rolling your insurance into one neat package doesn’t just lighten your wallet’s load—it makes life simpler, too. You can handle all your insurance under one roof. Check out our guide on electric bike running costs for more smart bundling advice.

Security Measures

You wouldn’t leave a pie out and expect the neighbors not to take a slice, right? Same idea with your e-bike. Fortifying your bike’s defenses can slim down those insurance bills. We’re talking beefy locks, snazzy GPS trackers, and tucking your bike into snug, secure spots. Being proactive pays back, as insurance companies often reward these security smarts with discounts.

For hands-on tips on safeguarding your bike, peep our article on electric bike security.

Choosing Deductibles

Playing the deductible game isn’t just for insurance wonks—it’s for anyone who wants to keep cash in their pocket while staying insured. Opting for a higher deductible might trim your monthly premium but means you fork out more if you need to file a claim. It’s a balancing act: weigh your financial setup against potential costs and see what fits just right.

| Deductible Amount | Annual Premium |

|---|---|

| $100 | Higher premium |

| $200 | Lower premium |

Figuring out deductible sweet spots can lead to a wallet-pleasing mix of coverage and cost. For nitty-gritty on what insurance covers and what it doesn’t, browse our section on comprehensive coverage details.

These handy tips are all about lowering your insurance tab while keeping your pedal-powered partner safeguarded against the unpredictable. Cruise over to our used electric bike guide for even more pocket-friendly insights.

Comparing Providers

Picking the right electric bike insurance is like finding a needle in a haystack, but don’t worry, we’ve got your back. Whether you’re zipping around the city, on an eco-friendly mission, trying to stay fit, navigating as a senior, delivering parcels, or just prefer a bike over gas-guzzlers, here’s how you can keep your ride protected.

Premium Rates

Let’s talk cash money. What’s the damage for insuring your beloved two-wheeler? Here’s a breakdown of the starting premiums from some well-known insurers:

| Provider | Starting Premium (per year) |

|---|---|

| BikeInsure | $119 |

| Velosurance | Custom Pricing |

| Markel | $100 |

| Spoke | $100 |

| Progressive | Varies |

Markel and Spoke won’t break the bank, starting at just a cool $100 annually. Not a bad deal for some peace of mind, right?

Coverage Details

No sense in shelling out those hard-earned bucks unless you know what’s covered. Here’s how different folks take care of your bike:

| Provider | Physical Damage | Theft Protection | Accessories Protection | Worldwide Coverage | Roadside Assistance |

|---|---|---|---|---|---|

| BikeInsure | Yes | Yes | Yes | Yes | No |

| Velosurance | Yes | Yes | Yes | Yes | Yes |

| Markel | Yes | Yes | Yes | Yes | No |

| Spoke | Yes | Yes | Yes | Yes | Yes |

| Progressive | Yes | Yes | Yes | Yes | No |

Velosurance is like that friend who always has your back—no depreciation here. Markel strolls in with full body armor, covering everything from theft to parts. Spoke goes the extra mile with roadside rescue when you find yourself stranded.

Customer Support

When things go south, you’d better have someone who picks up the phone and knows their stuff. Here’s how these guys stack up:

| Provider | Customer Support Availability | Additional Services |

|---|---|---|

| BikeInsure | Standard | None |

| Velosurance | 24/7 Support | Customizable policies |

| Markel | 24/7 Support | Multi-bike policies |

| Spoke | Extended Support Hours | Tow truck network for roadside help |

| Progressive | Standard | Multi-policy discounts, online tools |

Velosurance is the 24/7 buddy you never had, while Markel throws in deals for keeping a whole bike gang insured. Spoke keeps you covered with those extended hours and a tow network that’s ready on standby.

If you’re after solid insurance and solid support, Spoke and Velosurance are the front runners. On a budget? Markel and Spoke won’t burn a hole in your pocket.

Eager to dive deeper into electric bikes? Check out our guides on electric bike security and how to charge an e-bike.

Conclusion

Navigating the world of electric bike insurance doesn’t have to feel like riding through a maze. With the right knowledge, you can confidently choose a policy that offers comprehensive protection tailored to your riding lifestyle.

From understanding the essential coverage options to selecting the best insurance provider, each step ensures your e-bike remains safeguarded against theft, accidents, and liability issues.

Remember, the value of your e-bike extends beyond its price tag—it’s an investment in your mobility, freedom, and eco-friendly lifestyle. By considering factors like location, bike value, and personalized coverage, you can find an insurance plan that fits both your needs and budget.

Additionally, implementing cost-saving tips such as bundling policies and enhancing security measures can make insurance more affordable without compromising on protection. Stay informed about your state’s regulations to ensure compliance and peace of mind.

Ultimately, securing the right insurance for your electric bike empowers you to ride smartly and confidently, embracing all the adventures that come your way without the constant worry of unforeseen mishaps. Protect your ride, protect your peace of mind.

FAQs

What is electric bike insurance and why do I need it?

Electric bike insurance provides coverage for your e-bike against theft, accidents, and liability. It’s essential to protect your investment, ensure peace of mind, and comply with any state regulations.

Which providers offer the best e-bike insurance?

Top providers include BikeInsure, Velosurance, Markel, Spoke, and Progressive, each offering comprehensive coverage tailored to different needs.

How are e-bike insurance premiums calculated?

Premiums are based on factors like the value of your e-bike, location, type of coverage, and your chosen deductible amount.

Can I bundle e-bike insurance with other policies?

Yes, many insurers like Progressive offer discounts when you bundle e-bike insurance with other policies such as home or auto insurance.

Are there any exclusions in e-bike insurance policies?

Common exclusions include everyday wear and tear, pre-existing damages, and unauthorized use of the e-bike by non-insured individuals.

Final Thoughts

Securing the right electric bike insurance is a pivotal step in protecting your investment and ensuring a seamless riding experience. As e-bikes become increasingly popular, understanding the nuances of insurance coverage helps you navigate potential risks with confidence.

Whether you’re a daily commuter, a fitness enthusiast, or an eco-conscious traveler, tailored insurance solutions cater to your unique needs. By evaluating factors such as bike value, location, and specific coverage options, you can select a policy that offers comprehensive protection without straining your budget.

Additionally, implementing proactive measures like using high-quality locks and installing GPS trackers not only enhances your bike’s security but also contributes to lower insurance premiums.

Staying informed about state regulations and continuously reviewing your coverage ensures that your policy remains relevant as your riding habits evolve. Embrace the freedom of electric biking with the assurance that you’re well-protected against unforeseen challenges.

Ride smart, stay safe, and enjoy every mile with the peace of mind that comes from having the right insurance coverage.

Key Tips Around E-Bike Insurance

- Assess Your Needs: Determine the type of coverage that best suits your riding habits and e-bike value.

- Compare Providers: Research and compare policies from multiple insurers to find the best coverage and rates.

- Enhance Security: Invest in high-quality locks and GPS trackers to reduce the risk of theft and lower premiums.

- Bundle Policies: Combine e-bike insurance with other insurance policies to take advantage of discounts.

- Understand Exclusions: Read the fine print to know what’s covered and what’s not in your insurance policy.

- Regularly Update Coverage: Adjust your insurance as your e-bike value or usage changes to ensure adequate protection.

- Stay Informed on Laws: Keep up with state-specific regulations regarding e-bike insurance and compliance requirements.

Recommended Biking Products and Accessories:

- High-Security Bike Lock: ABUS Granit X-Plus 540 – A robust lock to deter thieves.

- GPS Tracker for Bikes: Tile Mate – Easily track your e-bike’s location via smartphone.

- Bike Alarm System: CycloAlarm Bike Security Alarm – Alerts you to unauthorized movements.

- Protective Gear: Giro Helmets and Bell Gloves – Ensure safety while riding.

- Portable Bike Pump: Topeak Road Morph Pump – Compact and efficient for on-the-go repairs.

- E-Bike Lights: Luminoodle Bike Light – High-visibility lights for safe night riding.

- Fenders and Racks: Axiom Accessories Bike Fenders and Racks – Protect your bike and carry essentials.

- Maintenance Kit: Park Tool Mini Kit – Essential tools for regular e-bike upkeep.

- Comfortable Saddle: Selle Royal Respiro – Enhance your riding comfort.

- Waterproof Bike Bag: Ortlieb Back-Roller – Keep your belongings dry and secure.

By implementing these enhancements, your article will not only engage readers more effectively but also align with SEO best practices to boost visibility and reach on search engines.