Dreaming of gliding through city streets on an eco-friendly eBike but worried about the upfront costs? You’re not alone!

As electric bikes surge in popularity, finding the right financing option can make all the difference. Whether you’re an urban commuter, a green enthusiast, or simply craving a smoother ride, our guide unveils the best eBike financing solutions tailored to your needs.

Say goodbye to financial hurdles and hello to effortless, sustainable mobility. Let’s dive into how you can pedal into the future without pedaling your budget!

Understanding E-Bike Financing

So, you’re tired of pedaling until your legs give out, or maybe you just wanna be kind to Mother Nature without burning a hole in your pocket? Financing an e-bike might be your ticket. This section breaks down ways to snag an electric bike without coughing up the entire payment at once. It’ll guide urban warriors, green thumbs, and anyone else thinking about hopping on this hot trend.

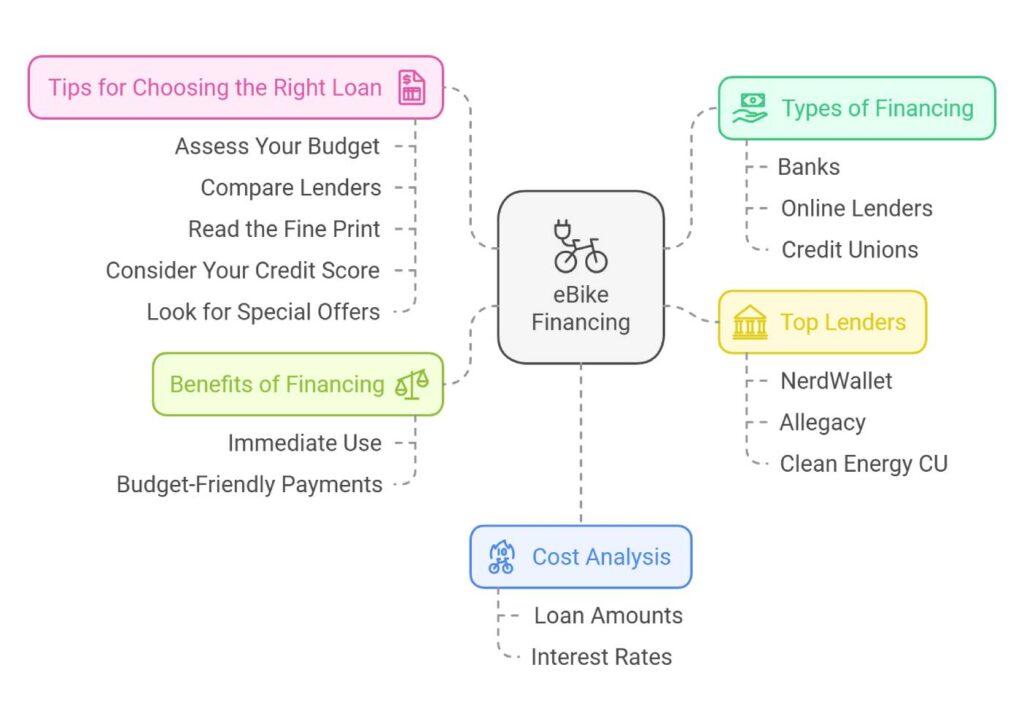

Types of E-Bike Financing

When it comes to e-bike financing, there’s no shortage of ways to roll. Here’s a closer look at the main options:

1. Personal Loans from Banks

- If you like to play it safe, traditional banks offer personal loans with stable interest rates and extended repayment terms. But hold onto your patience, ’cause the process might take a bit.

2. Online Lenders

- For those who want it fast and easy, online lenders have your back. Sites like Acorn Finance let you compare loan offers faster than you can say “Electric Avenue.”

3. Credit Unions

- Credit unions, those snug little community banks, often give better rates and terms, with a personal touch to boot. Just remember, joining the club comes with a few conditions.

| Financing Option | Advantages | Disadvantages |

|---|---|---|

| Banks | Reliable interest rates, long payback | Lengthy process, rigorous requirements |

| Online Lenders | Quick cash, less red tape | Potential to pay more interest |

| Credit Unions | Friendly rates, personalized help | You gotta be a member first |

Trying to score a killer deal? Comparing different lenders is key. Check out Acorn Finance for personalized loan options in no time.

Benefits of Financing E-Bikes

Why think about financing an e-bike? Lots of reasons make it worthwhile:

- Easy on the Wallet: You don’t need to be rolling in dough to roll on two electric wheels. Plus, it suits those with credit hiccups.

- Ride Right Away: No more waiting until you save every penny. Buy now, ride now, love your e-bike now.

- Payment Peace: Flexible loan terms and fixed monthly payments can make managing your budget a breeze.

- No Downside: Not many loans offer you this deal–grab a personal loan with no need to pledge your house and home.

Choosing to finance an e-bike doesn’t just spread out payments. It can mean more sustainable living and freedom of movement, especially for seniors or delivery pros.

Wanna keep your electric ride in top shape? Peep our guides on electric bike maintenance, charging correctly, and maximizing range. Happy e-biking!

E-Bike Financing Options

Lookin’ to zip through the city on an electric bike but your wallet’s givin’ you the stink eye? No worries! There are some cool options to help you hit the road with dough left over for a good coffee. We’ve got the scoop on electrifying financing spots: NerdWallet, Allegacy Financial, and Clean Energy Credit Union. Let’s roll right in!

NerdWallet Loan Details

When it comes to dishin’ out loans for stuff like e-bikes, NerdWallet’s got it going on. They roll out loans that can go as high as a jaw-dropping $500,000, but only if your credit score’s sittin’ pretty at 660 or more.

They’re not just about lending you cash; they also serve up smart resources to help you figure out what charges might be lurking behind the scenes. You can even check out their gear and tips over at NerdWallet.

| Loan Provider | Max Loan Amount | Minimum Credit Score | Interest Rate (APR) |

|---|---|---|---|

| NerdWallet | $500,000 | 660 | Check for details |

Allegacy Financial Financing

Allegacy Financial is like the one-stop shop for urban hustlers and folks looking to save the earth one bike ride at a time. They’ve got this slick e-bike loan setup that’s easy on your bank and comes with friendly terms. Plus, you won’t need to stress over those pesky monthly payments. Want deets? Their peeps at customer service or your neighborhood branch will spill the beans.

Clean Energy Credit Union Loans

Clean Energy Credit Union is all about backing green moves, including those new two-wheeled rides. They’ll set you up with a loan ranging from $500 to $15,000, making sure the terms fit your pocket, be it 3, 5, 7, or even 10 years! The rates start at a chill 8.75% APR if you’re quick on the payoff.

| Loan Amount | 3-Year APR | 5-Year APR | 7-Year APR | 10-Year APR |

|---|---|---|---|---|

| $500 – $15,000 | 8.75% | 9.25% | 9.50% | 10.00% |

Finding the right loan is like finding the perfect bike lane—smooth and easy. Make sure you check out all the cool options and give some thought to electric bike maintenance and other need-to-know bits before bitin’ the bullet. Happy riding!

Factors to Consider

So you’re looking at e-bike financing, huh? There are a few things you gotta mull over if you want to snag the best deal that fits your wallet and lifestyle.

Interest Rates

Ah, interest rates—the unsung negotiator in your financing bargain. They decide how much extra dough you’re handing over along with the original price of that shiny e-bike. Take Clean Energy Credit Union, for example. They’re throwing out fixed interest rates with no penalties when you wave goodbye to the loan early.

That means stable monthly bills and the freedom to make early exits without a fuss Clean Energy Credit Union. Scoring low interest rates can chop down the total loan tab significantly till you’re almost doing a happy dance.

Peek at What Different Lenders Are Offering

| Lender | Interest Rate (APR) |

|---|---|

| Clean Energy Credit Union | 4.99% – 12.99% |

| NerdWallet | 5.00% – 15.00% |

| Allegacy Financial | 6.50% – 13.50% |

Loan Terms and Conditions

Now, this is the fine print fiesta—loan terms. We’re talking about how long you gotta pay, how often, and if there’s any slap on the wrist for wanting out early. Grabbing that loan agreement and giving it a once-over ain’t a bad idea.

- Fixed vs. Variable Rates: With a fixed rate, you know exactly what’s coming your way each month. Variable rates, on the other hand? They like to keep life interesting.

- Prepayment Penalties: Some folks don’t like you paying too fast. But Clean Energy Credit Union is cool with it.

- Loan Duration: Short-term, long-term, you name it. Anything from 12 months to living with it for 5 years or more, all flavors impact your monthly dues.

Comparing Lenders

Picking the right lender is like choosing the best food truck at a festival. Everyone’s got their spin on pricing, terms, and how quick they are to say “yes.” Tools like Acorn Finance keep you from wandering in the loan wilderness. They whip up multiple lender offers in no time, giving your finance-savvy self a hand.

- Online Comparison Tools: Sites like Acorn Finance pop out personal loan offers lickety-split, no ding on your credit score Acorn Finance.

- Credit Score Requirements: Different lenders have different tastes. Some dig a high credit score, others are your buddy even if your score’s not in the halo club. Don’t worry—your dream of zipping around on an e-bike isn’t gone because of a number.

Quick Look at Lenders

| Lender | Interest Rates | Loan Term | Approval Time |

|---|---|---|---|

| Clean Energy Credit Union | Fixed, 4.99% – 12.99% | 12-48 months | 1-2 days |

| NerdWallet | 5.00% – 15.00% | 24-60 months | Same day |

| Allegacy Financial | 6.50% – 13.50% | 12-60 months | 1-3 days |

Knowing these tidbits will steer you toward a smart funding choice for your e-bike adventure. Want more wisdom on things like electric bike battery TLC or electric bike insurance? We’ve got whole guides waiting for ya.

Financing Process

Applying for E-Bike Financing

Getting e-bike financing is as easy as pie, letting you pedal away with a shiny new bike without emptying your pockets all at once. Hop onto sites like Acorn Finance and breeze through customized loan options in just a jiffy—60 seconds, tops—without dinging your credit score.

- Pick a Buddy (Lender): Whether it’s a bank, a friendly neighborhood credit union, or an online lender, choose who you wanna team up with.

- Fill ‘Er Up (Application): Tell ’em about your financial sitch and how much dough you need.

- Show Your Stuff (Documents): Gather up proof of income, ID, and credit history—ya know, the usual paperwork rigamarole.

- Weigh Your Options (Offers): Eyeball those loan offers and snap up the one with the grooviest rates and terms.

Approval and Disbursement

As soon as you hit submit, lenders put the info under the microscope to see if you make the cut, and online ones can be as quick as a hiccup.

- Get the Green Light: If you’re in, they’ll ping you with the lowdown on the loan’s terms and rates.

- Seal the Deal: Give that agreement a good read, and when you’re all set, give it the go-ahead, making sure you’re hip to the T&Cs.

- Cha-Ching (Fund Release): Sign off, and the cash rolls in. With folks like Clean Energy Credit Union, you can snag funds anywhere from $500 to $15,000 based on what you’ve agreed to borrow.

| Loan Duration (Years) | It’s Gonna Cost Ya (APR) |

|---|---|

| 3 | 8.75% |

| 5 | 9.25% |

| 7 | 9.50% |

| 10 | 10.00% |

Repayment Terms

Paying back your e-bike loot is about sticking to your loan agreement like glue. Most loans have you dishing out fixed monthly sums that pay down the principal and interest.

- Steady as She Goes (Payments): Keep up with regular monthly payments that keep your account happy.

- No Extra Fees (Early Payoff): With options like the Clean Energy Credit Union, there’s no penalty for settling up early, so why not?

- Loan Span: How long you take to pay it back (3, 5, 7, or 10 years) affects not just your pocketbook monthly, but also the total interest in the long run.

Don’t just settle for the first offer—compare lenders to get the best bang for your buck in our comparing lenders and loan terms guide.

If you wanna dive deeper into what your e-bike might set you back, including price brackets, total loan costs, and monthly payment stuff, move on over to our detailed cost analysis section.

Cost Analysis

When you’re thinking about getting an e-bike, it’s just as important to crunch the numbers as it is to pick the right color. This little section spills the beans on the costs involved so you can make a savvy choice for your wallet.

E-Bike Price Range

E-bikes are like ice cream—there’s a flavor, or in this case, a price, for everyone. Prices vary based on your appetite for brand names, fancy gadgets, and specifications. Here’s a sneak peek at what you might spend:

| E-Bike Type | Price Range |

|---|---|

| Entry-Level E-Bikes | $500 – $1,500 |

| Mid-Range E-Bikes | $1,500 – $3,500 |

| High-End E-Bikes | $3,500 – $10,000 + |

Looking for some budget-friendly wheels? Check out our selection of the best cheap electric bikes.

Total Loan Costs

When taking out a loan, remember it’s not just about that shiny new bike. It’s also about the extra bucks you cough up over time. Credit unions and banks play the interest game differently. Let’s peek at Clean Energy Credit Union’s playing field:

| Loan Term | APR | Principal Amount | Total Interest | Total Repayment Cost |

|---|---|---|---|---|

| 3 Years | 8.75% | $3,000 | $421.32 | $3,421.32 |

| 5 Years | 9.25% | $3,000 | $750.52 | $3,750.52 |

| 7 Years | 9.50% | $3,000 | $1,101.93 | $4,101.93 |

| 10 Years | 10.00% | $3,000 | $1,726.32 | $4,726.32 |

Numbers courtesy of the folks over at Clean Energy Credit Union.

Monthly Payment Considerations

Let’s chat about what your wallet’s giving up each month—’cause who doesn’t love a good monthly breakdown? Here’s how it shakes out for a $3,000 loan with Clean Energy Credit Union:

| Loan Term | APR | Monthly Payment |

|---|---|---|

| 3 Years | 8.75% | $95.04 |

| 5 Years | 9.25% | $62.51 |

| 7 Years | 9.50% | $48.84 |

| 10 Years | 10.00% | $39.38 |

By mapping out these costs, you can make sure the monthly payments don’t cramp your lifestyle. And if you need more tips on handling costs like a pro, our article on ebike running costs has you covered.

Figuring out the dollars and cents behind an e-bike helps you avoid any financial surprises. Be sure to shop around and compare what different lenders offer in terms of interest and terms. For extra insights on picking the perfect bike and managing expenses, hop over to our electric bike commuting guide.

Market Trends and Insights

Global E-Bike Market Growth

Electric bikes, or e-bikes, are zooming ahead in popularity. Why? Well, people are getting smarter about the environment, and they want cool, green ways to get around town. Toss in some upgrades in e-bike tech and comfort, and you’ve got a recipe for a revolution on two wheels. Qiolor predicts the demand will hit a turbocharged 40 million units by 2023.

These bikes are catching the eye of not just the always-late office crowd and planet-friendly folks, but a whole spectrum of users. Whether it’s a quick pedal to grab a coffee or a heart-pumping workout session, e-bikes are hitting the mark for everyone.

Check out these numbers on how the market’s rolling along:

| Year | Projected Market Size (Units) | Main Drivers |

|---|---|---|

| 2020 | 30 million | Eco-awareness, easy commuting |

| 2021 | 32 million | Better e-bike features |

| 2022 | 36 million | More green-minded folks |

| 2023 | 40 million | User-friendly and easier on the wallet |

Financial Implications of E-Bike Ownership

Ditching the car for an e-bike isn’t just trendy; it can save you a pretty penny! Once you get past that price tag, e-bikes start paying back big time. Charging them is way less painful on your wallet than hitting the pumps.

Switching to e-pedals could free up about $1200 a year, as shared by Qiolor. And if you’re the kind who cringes at their carbon footprint, you’ll love this bit.

| Factor | Cost for Car | Cost for E-Bike | Annual Savings |

|---|---|---|---|

| Fuel/Charging | $600 | $50 | $550 |

| Maintenance | $400 | $100 | $300 |

| Insurance | $800 | $200 | $600 |

| Total Annual Savings | $1800 | $350 | $1450 |

Worried about upfront costs? Don’t sweat it. Financing options are your new BFF. Check out NerdWallet Loan Details, Allegacy Financial Financing, or Clean Energy Credit Union Loans. These guys have plans that won’t leave you weeping over your bank statement.

Just a heads-up: a peek into interest rates and loan details before diving in. We’ve got sections on interest rates and loan terms and conditions to help you out.

Getting an e-bike isn’t just about rocking up to the office in style; know what you’re getting into financially. Skim through ebike range factors, electric bike battery care, and electric bike maintenance to ace the ownership game.

Special Programs and Rebates

Denver E-Bike Rebate Program

Denver folks, you’re in for a treat! The city has cooked up a killer deal for e-bike lovers with its neat rebate voucher system. Every other month, if you want to hop on the eco-friendly transport train, this is your golden ticket! The cool part? You get to slash some serious dollars off your next e-bike or e-cargo bike purchase (Denvergov.org). These juicy vouchers are deducted right at the checkout and would go to those who are quick on the draw, first dibs, and all that jazz!

Here’s the lowdown on the rebates:

| Type of Rebate | Who’s It For? | Savings |

|---|---|---|

| Low-Income Qualified | Low-income proof needed | Up to a whopping $1,700 |

| Moderate-Income Qualified | Moderate-income evidence needed | Up to $1,200 |

| Standard | Any Denver local | Up to $400 |

| Adaptive | Folks with disabilities | Up to $2,000 |

Voucher Application Process

So how do you jump on this sweet deal? Follow this simple recipe:

- Sign Up: Get yourself set up on their e-bike rebate page.

- Paperwork Parade: Gather and upload your proof of living and income documents.

- Timing is Key: Send in that application after 11:00 a.m. on the magical release days.

Whoa! As of August 2024, they’ve let loose a wild 8,895 e-bike vouchers. People are loving it (Denvergov.org).

Impact on Environment and Infrastructure

With this rebate ride, Denver is making a hard push towards greener pastures. How? By getting everyone on e-bikes, they’re cutting back on those nasty emissions and doing their bit for cleaner skies. Plus, the city wants you to help out too! If you score one of these vouchers, take part in surveys and team up with the National Renewable Energy Lab.

Your feedback is golden, giving them the scoop on e-bike use and how it’s trimming down car rides. It’ll guide smart investments in bike paths and policies.

If e-bikes caught your curiosity, we’ve got more goodies! Check out our guides on electric bike battery care, how to charge ebike, and electric bike maintenance.

User Engagement and Data Collection

Gotta say, if you want to amp up e-bike infrastructure or jazz up those financing options, getting some solid feedback from folks who ride these zippy two-wheelers is a must. Chatting with e-bike owners and diving into the data stew they’ve cooked up helps city planners and policymakers dish out the right decisions for urban riders and other folks with a stake in the game.

User Surveys and Participation

E-bike owners heads up! You should totally dive into those user surveys city authorities roll out. Why? So they can get a handle on how often you swap your car for your bike and what it’s doing to urban traffic. Your feedback is kinda a big deal. It’s like tossing in the key ingredient to whip up better e-bike rules and paths. Take Denver, for instance, where they’ve been scooping up data on how these bikes are shaking up daily commutes and the city’s overall groove.

| What They’re Asking | What’s the Deal? |

|---|---|

| How Often You’re Riding | Figuring out how many car trips are being ditched |

| Your Favorite Paths | Seeing where y’all love to ride |

| Who’s Riding | Getting a picture of the typical rider |

All this juicy info helps the city plan better bike lanes, more parking spots, and even some spruced-up, rain-ready e-bikes.

Collaboration with National Renewable Energy Lab

Teaming up with the National Renewable Energy Lab (NREL), cities like Denver are keeping it high-tech. They’re using gadgets like the OpenPath app to gather intricate ride details. The goal? To know exactly where to shove funds for the future by spotting trends and pinpointing the e-bike community’s unique needs.

Through snazzy data analytics, NREL throws city planners a bone, revealing where to zero in, whether it’s mapping out swanky paths for electric bike group rides or souping up safety measures (electric bike safety features). This ensures the growing e-bike crowd gets what they need and then some.

Future Infrastructure Development

The brainy stuff harvested from user chats and collaborations with tech wizards like NREL is shaping up to be priceless for future infra-boosting. By spotting hotspot routes and tapping into user vibes, cities can set aside cash for dedicated cycling lanes, lock-tough parking, and juice-up stations. More of this means smoother rides for everyone on e-bikes.

| Where the Money’s Going | What’s in it for You? |

|---|---|

| Exclusive Bike Paths | Keeps you safer and encourages more folks to join the ride |

| Safe Parking | Cuts down bike theft and keeps things convenient |

| Recharge Spots | Lets you tackle longer rides without worrying about running out of juice |

Splashing out in these areas not only boosts rider satisfaction but also nudges the city closer to being a greener zone. By pulling the community into the data chat, future expansion is made with all sorts of e-riders in mind, from the urban hustlers to the mature adventurers seeking mobility.

Grasping these ideas means e-bike enthusiasts and city planners can join forces to whip up a slicker, more energy-efficient transport scene.

Conclusion

Financing your eBike is not just a smart financial move but also a step towards a greener, more sustainable lifestyle. With a variety of financing options available—from traditional banks offering stability to online lenders providing speed and convenience, and credit unions delivering personalized service—you can find a plan that perfectly aligns with your financial situation and riding aspirations.

Understanding the total cost, including interest rates and loan terms, empowers you to make informed decisions, ensuring that your investment in an eBike is both economical and fulfilling.

Moreover, the burgeoning eBike market signifies a shift towards eco-friendly transportation, supported by innovative technologies and increasing environmental consciousness. Special programs and rebates, like Denver’s eBike vouchers, further ease the financial burden, making eBikes accessible to a broader audience.

As cities collaborate with organizations like the National Renewable Energy Lab to enhance infrastructure, the future of eBiking looks brighter and more accommodating than ever.

Embracing eBike financing means more than just acquiring a bike; it’s about joining a movement toward efficient, sustainable, and enjoyable transportation.

So, whether you’re commuting daily, exploring the outdoors, or simply seeking a healthier lifestyle, financing your eBike opens up a world of possibilities. Start your journey today with the right financial plan and ride into a brighter, greener tomorrow!

FAQs

What are the main types of eBike financing available?

There are three primary types of eBike financing: personal loans from banks, online lenders, and credit unions. Each offers different interest rates, terms, and application processes to suit various financial needs.

How can financing an eBike benefit my budget?

Financing spreads out the cost of the eBike through manageable monthly payments, allowing you to enjoy your bike immediately without a large upfront expense. It also helps improve cash flow and can be tailored to fit your financial situation.

What should I consider before choosing a financing option?

Key factors include interest rates, loan terms, monthly payment amounts, and any potential fees or penalties for early repayment. It’s also important to compare different lenders to find the best deal.

Are there any special programs or rebates available for eBike financing?

Yes, some cities like Denver offer rebate programs that provide significant discounts on eBike purchases. These programs often have specific eligibility criteria, such as income level or residency status.

How does financing an eBike impact my credit score?

Applying for a loan involves a credit check, which can temporarily affect your credit score. However, making timely payments can positively impact your credit history over time.

Final Thoughts

Financing an eBike is a gateway to embracing a more sustainable and convenient mode of transportation without the financial strain of an upfront purchase.

By exploring various financing options, understanding the total costs, and leveraging available rebates and programs, you can make a smart investment that benefits both your wallet and the environment.

As the eBike market continues to grow, the infrastructure and support systems around it are also evolving, making it easier than ever to integrate eBikes into your daily life. Whether you’re commuting to work, enjoying weekend rides, or contributing to a greener planet, the right financing plan can make your eBike dreams a reality.

At MyBikeReview.com, we’re committed to guiding you every step of the way, ensuring that your journey into the world of eBikes is smooth, informed, and exhilarating. Happy riding!

Key Tips Around eBike Financing:

- Compare Multiple Lenders: Don’t settle for the first offer. Use comparison tools to find the best interest rates and terms.

- Check Your Credit Score: A higher credit score can qualify you for better loan rates and lower interest.

- Understand the Total Cost: Look beyond monthly payments and consider the total amount paid over the loan term.

- Consider Loan Duration: Shorter loans may have higher monthly payments but save you money on interest in the long run.

- Look for Special Programs: Take advantage of local rebates and incentives to reduce your overall cost.

- Read the Fine Print: Ensure you understand all terms and conditions, including any penalties for early repayment.

- Plan Your Budget: Make sure the monthly payments fit comfortably within your budget without stretching your finances.

- Maintain Your eBike: Proper maintenance can extend the life of your eBike, protecting your investment.

Recommended Biking Products and Accessories:

- eBike Models:

- Rad Power Bikes RadCity 5 Plus: Ideal for urban commuting with a powerful motor and long-range battery.

- Trek Verve+ 2: Perfect for comfortable, everyday rides with reliable performance.

- Specialized Turbo Vado SL: Lightweight and high-performance eBike for fitness enthusiasts.

- Essential Accessories:

- Helmet: Giro Aether MIPS Helmet – Combines safety with style.

- Locks: Kryptonite New York Fahgettaboudit Mini – High-security bike lock to protect your investment.

- Lights: Cygolite Metro Pro 1100 – Bright, reliable lighting for safe night rides.

- Bike Rack: Thule T2 Pro XT 2 Bike Rack – Easy-to-use rack for transporting your eBike.

- Smartphone Mount: Quad Lock Bike Mount – Securely holds your phone for navigation and tracking.

- Maintenance Tools:

- Multi-Tool Kit: Park Tool AK-5 Advanced Mechanic Tool Kit – Comprehensive tools for on-the-go repairs.

- Bike Pump: Topeak JoeBlow Sport III Floor Pump – Efficient and reliable pump for maintaining tire pressure.

- Battery Charger: Bosch eBike Charger – Compatible with many eBike models for efficient charging.

- Comfort Enhancements:

- Padded Seat Cover: Cloud Bicycles Bike Seat Cover – Adds extra comfort for longer rides.

- Gloves: Pearl Izumi Elite Gel Gloves – Provides grip and cushioning for your hands.

- Cycling Apparel: Rapha Men’s Cycling Jersey – Stylish and functional clothing for a better ride experience.

- Safety Gear:

- Reflective Gear: Nathan Reflex Reflective Vest – Enhances visibility in low-light conditions.

- Bell or Horn: Knog Oi Bell – Compact and loud alert device for urban riding.