Cycling enthusiasts know that safeguarding their prized bikes is as crucial as choosing the perfect ride. Navigating the maze of bike insurance can feel overwhelming, but finding the right policy ensures peace of mind on every pedal.

Imagine hitting the trails or city streets without worrying about theft, accidents, or unexpected damages. At MyBikeReview.com, we simplify the process, breaking down premiums, coverage benefits, and essential factors to help you make informed decisions.

Whether you’re a casual rider or a seasoned pro, our guide to comparing the best bike insurance will keep your wheels turning smoothly and securely.

Comparing Bike Insurance Policies

Picking the right bike insurance is like finding the perfect saddle—it’s gotta fit just right to protect your favorite set of wheels. Forget the legalese and fancy talk; let’s put it simply. Knowing your premium and coverage perks will make that tough choice feel like a breeze.

Understanding Premium Amounts

Your insurance cost can vary as much as the terrain on a weekend ride. From the price of your bicycle to the coverage deal you pick, everything matters. Checking out different quotes is key—kind of like shopping around for the best trail mix.

Here’s how your insurance math works out:

| Factor | Impact on Premium |

|---|---|

| Bicycle Value | Pricier bike = Pricier insurance |

| Coverage Type | All-inclusive or just the basics |

| Deductible Amount | Higher deductible = Lower price tag |

| Customization | Pimped-out bike = Higher cost |

| Location | Live in Bike Thief Central? Pay more |

| Discounts | Safety courses, upfront payments save dough |

Getting the lowdown on these can help you pick a policy that’s easy on your wallet but still keeps your bike safe. Want more on playing the insurance game smart? Check out our bike insurance guide.

Analyzing Coverage Benefits

Now, let’s get into what you actually get for your money. Not all insurance is created equal. Some just cover theft and dings, while others throw in personal injury and gear protection.

Check these typical benefits out:

| Coverage Benefit | Description |

|---|---|

| Theft Protection | Replace your bike if it gets swiped |

| Accidental Damage | Pays for those “oops” moments |

| Liability Protection | Covers if you accidentally hurt someone |

| Personal Injury | Helps cover medical bills from spills |

| Accessory Coverage | Protects extras like your snazzy lights |

| Worldwide Coverage | Covers your bike adventures globally |

Some policies are loaded with extras. Velosurance, for instance, extends its global reach beyond domestic borders, covering theft and travel mishaps. Progressive goes another mile with full replacement costs, avoiding depreciation.

The right plan mixes reasonable cost with solid protection—kind of like picking the right gear for a steady uphill. For more tips and advice, swing by our bike insurance guide.

Nailing down the perfect balance of premium versus perks is your ticket to stress-free cycling. You want protection, but no budget-breaking surprises. Seeking more insights? Pedal over to our pages on bike ownership cost and bike warranty guide.

Essential Factors for Comparison

Choosing the right bike insurance is like picking the right pair of shoes – you want it to fit just right and get the job done. Two biggies to look at are how quickly they pay (claim settlement ratio) and how quickly they pick up the phone when you call (customer support).

Claim Settlement Ratio Insights

Think of the claim settlement ratio as a report card for insurance companies. A higher grade means they’re quick to toss cash your way when you need it. It’s like when you need a plumber at 3 a.m. and they actually show up. Articles Factory says to aim for a company that scores high in this department so you’re not left high and dry.

Here’s a totally made-up example to give you an idea:

| Insurance Company | They Pay Up Ratio |

|---|---|

| Company A | 95% |

| Company B | 90% |

| Company C | 85% |

| Company D | 80% |

Always take a peek at the latest buzz (reviews and ratings, I mean) to make sure they’re still in top form.

Evaluating Customer Support

Picture this: You have a flat tire and you don’t know how to fix it. Who do you want on the other end of that call? Someone who’s actually helpful, that’s who. The same goes for insurance. A company with great customer support turns a bad situation into something that’s at least bearable.

As Articles Factory suggests, check out how easy it is to get ahold of them, whether their team knows what they’re talking about, and how fast they solve your problems.

If you’re eyeing a new bike, don’t forget to swing by our pages on the bike price guide and where to buy bikes for more handy tips.

Other cool reads for bike enthusiasts include:

- bike price tracking

- bike warranty guide

- document bike condition

By zoning in on these must-knows, you’ll be all set to find bike insurance that’ll ride along perfectly with your needs.

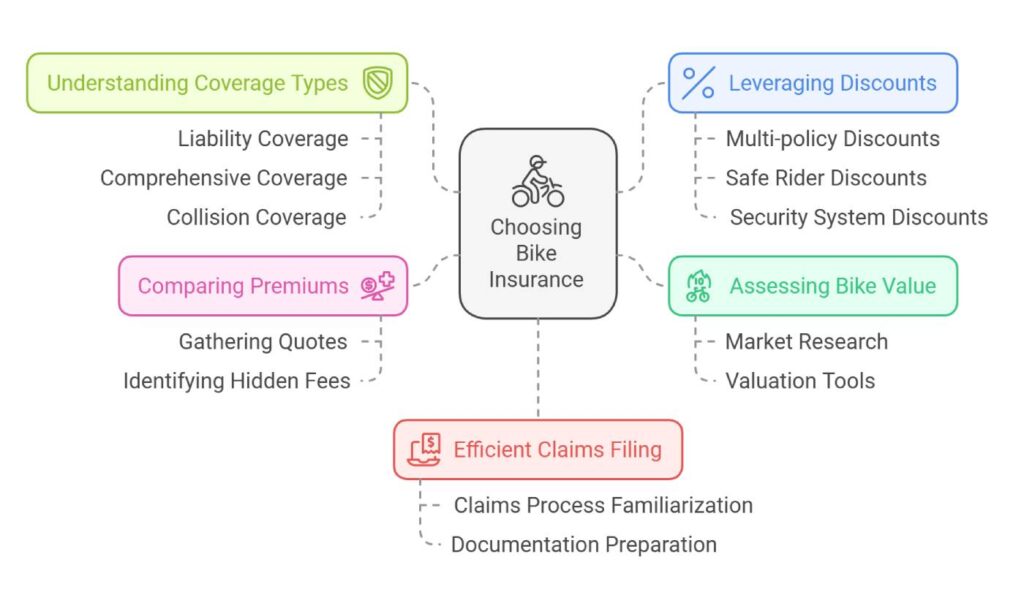

Choosing the Right Policy

Importance of How to Buy

When you’re shopping for bike insurance, an important thing to keep an eye on is how you plan to buy it. This choice doesn’t just affect the starting price you pay; it also impacts how smooth and supportive your journey will be with the policy. Here’s a peek at three common ways to buy bike insurance and how they might shape up your experience:

1. Online Purchase

- Ease: Kick back, sip your coffee, and compare insurance options right from your couch.

- Quick Process: Fast-track your way into protection with instant policy issuance.

- Open Pricing: Snag those discounts and competitive prices directly from the insurance hub.

- Help on Tap: Chat and email support standing by to untangle your questions and fix issues.

2. Agent or Broker

- Up Close and Personal: Enjoy the perks of tailored advice with face-to-face chats.

- Claims Buddy: Extra hands with paperwork and dealings if something goes wrong.

- Exclusive Access: Agents can sometimes hook you up with special policies and sweet deals.

3. Insurance Company Offices

- Face-to-Face Clarity: No middleman, just you and the insurance folks for clear, straight talk.

- On-the-Spot Help: Get immediate answers and assistance right there on the spot.

Best Practices for Selection

To find your perfect bike insurance match, you need to weigh several factors to ensure you’re getting a worthwhile deal:

1. Check Coverage Possibilities

- Look into what different policies offer; go beyond the basics and include coverage like theft, damages, and third-party mishaps.

- Hunt for add-ons such as roadside help, personal injury cover, and depreciation busters.

2. Compare the Costs

- Fire up those online tools to browse and estimate prices from various companies.

- Make sure what you’re paying matches up with the coverage you’re getting—it’s all about bang for your buck.

3. Look at the Claim Track Record

- Dig into the company’s claim settlement record to see if they treat folks right when the chips are down.

- A higher score usually means more ???? on getting claims approved.

4. Judge Their Customer Service

- Scan through reviews about their handling of customer queries and support.

- Ensure you’ll have a supportive team backing you up with easy claims and speedy fixes.

5. Understand the Fine Print

- Go through the details with a fine-tooth comb to know what’s not covered and any sneaky conditions.

- Being in the know helps dodge unpleasant surprises down the road.

| Best Practices | Things to Ponder |

|---|---|

| Coverage Choices | Beyond basics, include extras like theft help |

| Cost Comparison | Use tools, hunt for value |

| Claim Record | Rely on their claim process |

| Client Care | Reviews speak volumes, look for strong support |

| Fine Print | Details matter, find out exclusions |

By sticking to these practices, you’ll have a much clearer path to selecting the right bike insurance. For more tips and tricks, swing by our bike insurance guide and make sure you’re making smart choices.

Keep digging into the info about bike insurance comparisons with our bike warranty guide and top bike brands to ride out with full peace of mind and satisfaction on every journey.

Best Insurance Options

Velosurance Coverage Details

Velosurance keeps your wheels safe, no matter what you pedal. They’ve got your back whether you’re riding a road bike, mountain bike, e-bike, or even one of those quirky trikes.

Coverage Benefits:

- Crash Damage: If your pride and joy get a ding while zooming down roads or trails, or during a race, Velosurance covers the repair bills.

- Theft Coverage: Your bike’s protected from sneak thieves whether it’s locked up at home, at your job, or in your car.

- Total Loss: If the worst happens and your bike’s toast, you’ll get to replace it with one of equal value.

- Worldwide Coverage: Whether you’re biking around the block or globetrotting, coverage stretches outside the USA and Canada for physical damage and theft—yes, even for those pesky airline mishaps.

Curious about how to keep your bike safe? Check out our bike insurance guide.

Coverage Overview:

| Coverage Type | Details |

|---|---|

| Crash Damage | Repairs for accidents on the road, trail or while racing. |

| Theft Coverage | Guards against theft from various secure spots. |

| Total Loss | Full value replacement without losing out on depreciation. |

| Worldwide Coverage | Global protection beyond USA and Canada. |

Progressive Insurance Offerings

When it comes to motorcycle insurance, Progressive’s a top dog offering lots of bells and whistles like full replacement cost and coverage for your fancy gadgets, all without extra fees.

Coverage Benefits:

- Bodily Injury and Property Damage Liability: Covers the cost when someone else gets hurt or their stuff gets damaged.

- Uninsured/Underinsured Motorist Coverage: Protects you if you’re hit by drivers whose insurance isn’t up to snuff.

- Comprehensive and Collision Coverage: Shields against theft, random acts of vandalism, Mother Nature’s tantrums, and fender benders.

- Medical Payments: Takes care of medical bills in a smash-up.

- Additional Coverages: Includes goodies like complete loss replacement, roadside help, and protection against trip interruptions.

Want to pit bike insurance plans against each other? Take a peek at our compare bike insurance page.

Coverage Overview:

| Coverage Type | Details |

|---|---|

| Bodily Injury and Property Damage Liability | Covers injuries to people and damage to their stuff. |

| Uninsured/Underinsured Motorist Coverage | Keeps you safe from poorly insured drivers. |

| Comprehensive and Collision Coverage | Guards against theft, vandalism, and disasters, plus collision ruin. |

| Medical Payments | Takes care of doctor bills when accidents happen. |

| Additional Coverages | Total loss, roadside rescue, and trip disturbance coverage included. |

Picking the right policy means figuring out what you need most. Get more tips from our bike warranty guide.

Discounts and Savings

Figuring out how to snag discounts while scoring the best bike insurance can keep your wallet a bit heavier. Here’s how to squeeze the most savings out of your coverage.

Getting Your Premium Down

Insurance folks ain’t shy about handing out discounts. Knowing the ins and outs can keep your costs down.

| Discount Type | What It Means For You |

|---|---|

| Experienced Rider | You’ve been around the block a few times (on a bike, that is) and you’re a safe bet, so your rate’s lower. |

| Anti-theft Devices | Outfit your ride with some lock-and-key magic, and they might cut you a break. Less risk for them, less price for you. |

| Upfront Payment | Pay all at once and you’ve got a deal, as they appreciate not having to chase you down for monthly payments. |

| Multi-Bike Policy | More bikes, more savings. Keep ’em under one plan to watch the costs go down. |

| Multi-Policy Bundle | Bundle up your bike, car, or even your house coverage and get a sweeter deal. |

Making Your Policy Work Hard

To squeeze every drop out of your bike insurance policy, try these tips.

- Pick the Right Coverage: Make sure you’re covered against every hiccup—be it theft, a scratch, or worse.

- Get Smart with Deductibles: Think about what makes sense financially: a lower payment every month but larger out-of-pocket or smaller immediate costs if something happens.

- Cash In on Those Discounts: Don’t leave money on the table. Use those discounts from being a pro rider, installing safety gadgets, or policy bundling to lighten the financial load.

- Annual Policy Check-up: See if changes in your life may need changes in your policy or unlock some fresh new discounts.

- Beef Up on Safety Measures: Throw in some security gear—it’s peace of mind and might bring your premium down too.

By fine-tuning these details, you’re in the driver’s seat to pick the best policy for your needs. For a nitty-gritty guide on bike insurance specifics, hop over to our bike insurance guide.

Need more gear tips? We’ve got you covered:

- where to buy bikes online

- best bikes by price

- bike price tracking

- bike ownership cost

Additional Considerations

Picking the right bike insurance goes far beyond just watching those premium dollars. Knowing the types of bike insurance and giving the policy terms and conditions a good read are key parts of choosing wisely.

Types of Bike Insurance

When you’re sizing up bike insurance policies, it’s good to know the different coverage options. Here’s the breakdown:

Comprehensive Insurance

Comprehensive bike insurance is like the Swiss Army knife of coverage. It not only covers damage to your bike but also third-party liabilities and personal accidents. Plus, extras like roadside help, along with protection against Mother Nature, theft, and just plain nastiness are often thrown in for good measure.

Third-Party Liability Insurance

This one’s for when your bike meddles with someone else’s stuff. It’s the mandatory barebones insurance covering damages to a third party. Your bike’s repairs though? That’s on you.

Personal Accident Coverage

This is your medical buddy in case you hit the turf while biking. Whether it’s part of a comprehensive policy or a separate plan, it handles the hospital bills and maybe even compensates a bit.

Add-On Covers

Add-ons are like the toppings on your insurance sundae. Think depreciation cover, engine protection, and zero depreciation cover. Such add-ons are great for beefing up coverage on shiny new bikes or if you want to be super safe.

| Type of Insurance | What It Covers | Extra Benefits |

|---|---|---|

| Comprehensive | Bike damage, others’ expenses | Roadside help, theft, vandalism |

| Third-Party | Damage to others | Legal box checked |

| Personal Accident | Your medical bills | Standalone or with comprehensive |

| Add-On Covers | Special needs protection | Extra shield for certain needs |

Knowing these types gives you a head start in picking the right one. For even more details, check out our guide to bike insurance.

Policy Terms and Conditions Review

Taking a magnifying glass to the policy’s terms and conditions is very smart when you’re shopping for bike insurance. Here’s what to keep your eye on:

Coverage Details

Make sure you know what you’re getting and, importantly, not getting. Scour the small print for any gotchas. Comprehensive coverage should protect from numerous mishaps, while third-party and personal accident policies take care of particular troubles (LinkedIn).

Claim Process

Get the down-low on filing claims and what paperwork you’ll need. Double-check for any hidden roadblocks that might delay things. The simpler the process, the better—and go with insurers noted for quick claim resolutions.

Premium and Deductibles

Size up premium costs and deductibles across different policies. A high deductible usually equals a lower premium, but keep in mind, that this also means more out of your pocket if things go pear-shaped.

Network of Garages

Seek out insurance providers with a strong lineup of authorized garages offering cashless claim hooks. This feature can cause a whole load of headaches when your ride needs to visit the bike doctor.

Keeping these tips in your back pocket helps in choosy, savvy decision-making when comparing bike insurance. If you’re craving more info, check out compare bike specs, best bike brands, and our bike registration guide.

Bicycle Insurance Insights

Coverage Options Explained

Choosing the right bicycle insurance ain’t rocket science, but it surely helps to know what you’re getting into. A solid bicycle insurance policy can act like a guardian angel for your two-wheeler, making those unexpected hiccups (like bike theft or accident) a little less painful. Here’s what you need to know:

- Theft Protection: Ever had that heart-sinking moment when your bike’s MIA? This coverage steps in to cover the cost of replacing your stolen bike. Perfect for those in city areas or places where thieves are known to lurk.

- Accidental Damage: Life happens, and sometimes that means your bike takes a hit. This covers repair or replacement if your bike has a rough day.

- Personal Injury: For bumps, bruises, or worse—this coverage helps with medical bills if you get hurt while riding.

- Liability Protection: If you accidentally cause someone else to get hurt or damage their property while biking, this one’s for handling the potential legal mishaps.

- Accessory Coverage: Got fancy gadgets like lights, bags, or racks? Keep ’em protected too.

Want more juicy details? Check out our bike insurance guide.

Determining Adequate Coverage

Finding that sweet spot of coverage takes a few smart moves. It’s all about what your bike’s worth, how you ride, and what suits your wallet. Here’s a step-by-step guide to help you pick the right insurance plan:

- Assess Your Bike’s Value: Know how much your bike’s worth. Fancy bikes often need more insurance to cover their cost (Renewed Group).

- Understand Premiums and Deductibles: It’s like a seesaw—lower deductibles usually mean paying more upfront in premiums, and vice versa. Pick what suits your financial range best.

- Consider Your Riding Habits:

- If you’re pedaling out daily or over rough terrains, you’ll likely want more extensive coverage.

- For the laid-back rider who hits the park path once a month, basic might be plenty.

- Review Policy Terms: Double-check that your policy’s not missing anything you need, like cover for international rides or pro biking events.

| Factor | Consideration | Impact on Coverage |

|---|---|---|

| Bike Value | High-end/custom bikes | Needs higher coverage limits |

| Usage Frequency | Daily vs. casual use | Influences premium and coverage type |

| Accident and Theft Rate | High-risk spots | Calls for comprehensive plans |

| Additional Gear | Accessories, custom parts | Key to include in coverage |

Want even more tips on the perfect policy? Look into our best bike brands and bike ownership cost guides to round off your research.

Pinning down the right bicycle insurance might seem like a hefty job, but once you get the hang of these coverage options, you’ll be cruising with peace of mind. Size up your bike’s worth, weigh premiums versus deductibles, and read the fine print—your ideal insurance is out there!

Claims Process Guidance

Trying to figure out the claims process for your bike insurance? It’s not always a walk in the park, but with a bit of know-how and some inside tips, you’ll soon be breezing through it. Let’s break it down together, shall we?

Efficient Claim Filing Tips

When it comes to your bicycle insurance, filing a claim quickly and accurately can make your life a whole lot easier. Here’s your game plan:

- Speak Up ASAP: As soon as your bike gets into trouble, ring your insurance company. Waiting around could mess up your claim or even void it.

- Collect Your Papers: You’ll need photos of the damage, any police reports if they apply, and receipts for things you’ve bought. Having these at hand gives your claim some muscle.

- Stick to the Script: Each insurance company has its own way of handling claims. Do what they say to keep things moving. Check out our bike insurance guide for step-by-step help.

- Keep Talking: Stay in touch with the insurance folks while your claim’s in play. Regular updates could get you to the finish line faster.

| Step | Action |

|---|---|

| 1 | Tell your insurance about the incident right away |

| 2 | Gather all your proof (photos, reports, receipts) |

| 3 | Go through the insurance’s claim process |

| 4 | Stay in regular contact |

For extra nuggets of wisdom, our bike theft protection and bike extended warranty guides have got you covered.

Understanding Policy Restrictions

Getting cozy with the nitty-gritty of insurance policies is the smart way to know what’s not covered. Some might say no to racing, certain kinds of damage, or be picky about where you park your ride. So make sure you:

- Read Every Word: Know what’s on the list and what’s not.

- Ask the Tough Questions: Get the lowdown on high-risk activity exclusions or storage no-nos.

- Check Parked Rules: See if your bike needs to be in a specific spot to keep the insurance in good shape.

Getting this info upfront means no nasty surprises when it comes time to claim. Our bike warranty guide and document bike condition have tips that’ll back up your claim.

Stick to these tips and make sense of what your policy offers and you’re on your way to making this claim a breeze if it ever comes to that. For more bike love, swing by our pages on bike frame sizing and compare bike specs to see how you can keep your bike (and its coverage) in tip-top form.

Conclusion

Choosing the right bike insurance is more than just a financial decision—it’s about protecting your passion and ensuring every ride is as carefree as possible. From understanding the nuances of premium calculations to evaluating the breadth of coverage benefits, each step plays a vital role in securing your investment.

Remember, comprehensive insurance offers extensive protection, but even basic policies can provide essential safeguards against theft and accidental damage. Prioritize insurers with high claim settlement ratios and stellar customer support to guarantee swift assistance when needed.

Don’t overlook the power of discounts and smart policy selections to maximize your coverage while keeping costs manageable.

By thoroughly assessing your bike’s value, riding habits, and specific needs, you can tailor a policy that offers both robust protection and financial peace of mind. At MyBikeReview.com, we’re committed to guiding you through every twist and turn of the insurance landscape, ensuring you pedal forward with confidence and security.

Equip yourself with the right knowledge, choose wisely, and enjoy the open roads knowing your bike is well-protected.

FAQs

What factors affect bike insurance premiums?

Premiums are influenced by your bike’s value, coverage type, deductible amounts, customization, location, and available discounts.

What types of bike insurance coverage are available?

Comprehensive, third-party liability, personal accident, and various add-ons like accessories and worldwide coverage are available.

How can I lower my bike insurance costs?

You can reduce costs by leveraging discounts for experienced riders, installing anti-theft devices, opting for higher deductibles, and bundling policies.

What should I look for in a bike insurance provider?

Focus on a high claim settlement ratio, excellent customer support, comprehensive coverage options, and positive reviews.

How do I file a bike insurance claim efficiently?

Report the incident immediately, gather necessary documentation, follow the insurer’s claim process, and maintain regular communication with your provider.

Final Thoughts

Navigating the world of bike insurance doesn’t have to be daunting. By understanding the key factors that influence premiums, the variety of coverage options available, and the importance of reliable customer support, you can make informed decisions that protect both your bike and your peace of mind.

Remember to assess your specific needs, whether you’re a daily commuter or a weekend adventurer, and choose a policy that offers the right balance of coverage and cost. Utilizing available discounts and staying proactive in reviewing your policy can lead to significant savings and enhanced protection.

At MyBikeReview.com, our mission is to empower you with the knowledge and resources necessary to secure the best insurance for your ride. Embrace the freedom of the open road, knowing that you’re well-protected against life’s unexpected turns. Happy cycling!

Key Tips

- Assess Your Needs: Determine the level of coverage based on your bike’s value and your riding habits.

- Compare Policies: Use online tools to compare premiums, coverage benefits, and deductibles from multiple insurers.

- Check Reviews: Look for insurers with high claim settlement ratios and positive customer feedback.

- Leverage Discounts: Take advantage of available discounts for safe riding, anti-theft devices, and policy bundling.

- Read the Fine Print: Understand policy exclusions and conditions to avoid surprises during claims.

Recommended Biking Products and Accessories

- Bike Locks: Kryptonite New York Fahgettaboudit U-Lock – Maximum security for your bike.

- Helmet: Giro Aether MIPS – Superior protection with advanced ventilation.

- Lights: Cygolite Metro Pro 1100 – Bright and reliable for night rides.

- Bike Pump: Topeak JoeBlow – Portable and efficient for on-the-go inflation.

- Maintenance Kit: Park Tool AK-5 Advanced Mechanic Kit – Comprehensive tools for bike upkeep.

- Cycling Gloves: Giro Bravo Gel – Comfort and protection for long rides.

- GPS Tracker: Tile Mate – Keep track of your bike’s location to prevent theft.

- Bike Cover: Pro Bike Tool Bike Cover – Protect your bike from the elements.

- Cycling Apparel: Pearl Izumi Quest Jacket – Weather-resistant and breathable for all conditions.

- Accessory Mounts: Topeak MTX Trunk Bag – Convenient storage for essentials during rides.

By enhancing your bike insurance knowledge and leveraging these resources, you’re well-equipped to protect your two-wheeled companion and enjoy every journey with confidence.