Dreaming of hitting the open road on a new motorcycle but are daunted by the financing process? You’re not alone. Navigating motorcycle loans can feel like riding through uncharted terrain, but with the right guidance, it becomes a smooth journey.

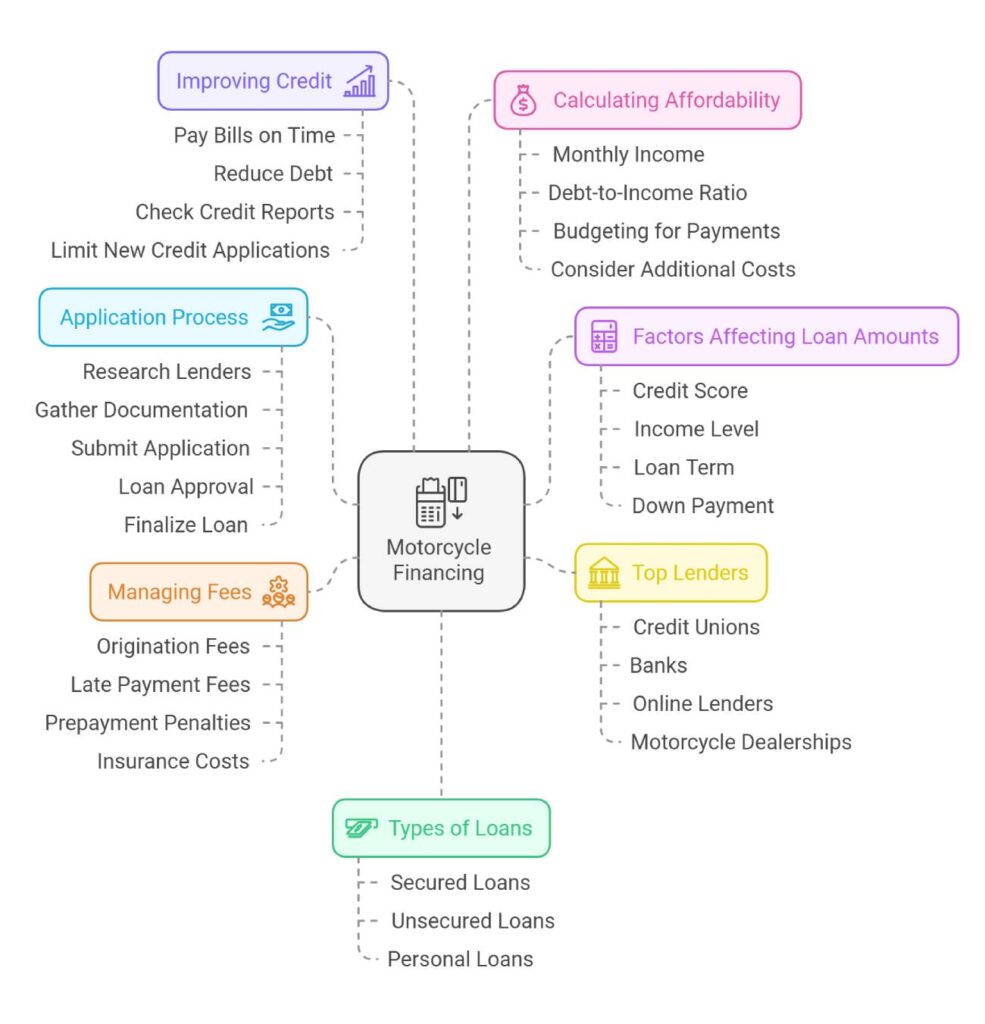

Whether you’re a first-time buyer or looking to upgrade your ride, understanding the ins and outs of motorcycle financing is crucial. From choosing between secured and unsecured loans to improving your credit score for better rates, this comprehensive guide is your ticket to making informed financial decisions.

Let’s rev up your knowledge and steer you towards the best financing options for your dream bike!

Understanding Motorcycle Financing

Getting a loan to buy a motorcycle doesn’t have to be rocket science. Once you’re clued up on the types of loans out there and what impacts the dough you can borrow, you’re halfway there. So, jump on as we take a ride through the key stuff you need to know.

Types of Motorcycle Loans

Motorcycle loans come in two main flavors: secured and unsecured.

- Secured Loans: Ever heard of collateral? That’s what these loans are all about—your shiny, new motorcycle stands as the security. Because it’s kinda ‘guaranteed’, the lender often offers lower interest rates, so your budget can breathe easy. The catch? You might have to pitch in a down payment first.

- Unsecured Loans: These are like a handshake deal, no motorcycle is held hostage if you mess up on payments. But be warned, they’ll come knocking with steeper interest rates and potential fees.

Comparison Table for Loan Types

| Loan Type | Collateral Required | Interest Rates | Down Payment Required | Fees |

|---|---|---|---|---|

| Secured Loan | Yep | Low | Sometimes | Low |

| Unsecured Loan | Nope | High | Nah | High |

Factors Affecting Loan Amounts

Here’s what might sway how much loan dough you qualify for, and the terms tied to it:

- Credit Score: Your magic number can make or break the deal. Good scores can reel in lower rates and bump up how much you can borrow. To spruce it up, try paying off debts and keeping an eye on your credit report.

- Down Payment: Shelling out more upfront might slim down the actual loan you need, plus sweeten your rate. Chat with lenders to see how much of a down payment you can swing.

- Income and Debt: Lenders will peek at your debt-to-income ratio. Less debt and more cash flow will boost your chances for better loan terms.

- Market Conditions: Interest rates are as shifty as the weather. Keep an eye on the trends so you can catch a good rate when applying.

- Loan Term: Terms run from a quick 12 months to a more relaxed 84. Shorter means heftier monthly payments but less interest overall. Longer terms lighten the monthly load but you end up paying more in interest.

Considering these points will make tackling that motorcycle loan a breeze. If you’re hunting for more ways to snag the best financing deal, check out our tips on choosing repayment terms.

This guide is revved up to be your go-to when buying your first bike, trading up your ride, or just doing some savvy research before making that all-important purchase.

Best Options for Motorcycle Loans

So, you’ve got your eye on a sleek motorcycle and now you’re on the hunt for the perfect loan to make it yours. Whether you’re jumping into the world of motorcycles for the first time, looking to upgrade your current ride, or just smart about sticking to your budget, we’ve got the lowdown on some top-notch lenders that could make your two-wheeled dream a reality.

NASA Federal Credit Union

NASA Federal Credit Union might sound out of this world, but they’re actually a down-to-earth choice for motorcycle loans. They’re kind of famous for offering a bunch of loan options and handing out generous loan amounts compared to some other places.

If you’re eyeing a fancy bike or just a modest one, they’ve probably got you covered.

What’s Cool:

- Tons of loan choices

- Big loan amounts

- Pretty decent interest rates

| Feature | Detail |

|---|---|

| Minimum Loan Amount | $4,000 |

| Maximum Loan Amount | $100,000 |

| APR | 5.25% – 9.49% |

| Loan Term | 12 – 84 months |

Southeast Financial

Got a blemish or two on your credit score? Southeast Financial could be the perfect buddy for you. They team up with lots of partner lenders and are pretty chill about credit scores, needing just a minimum score of 575 to get the ball rolling.

What’s Cool:

- Works with lots of lenders

- Soft spot for not-so-great credit (just 575 needed)

- Loads of loan options to choose from

| Feature | Detail |

|---|---|

| Minimum Loan Amount | $7,500 |

| Maximum Loan Amount | $40,000 |

| APR | 5.75% – 16.95% |

| Loan Term | 24 – 84 months |

Digital Federal Credit Union

Digital Federal Credit Union (DCU) is in the mix with low interest rates and even offers some discounts for those in the know. However, don’t expect to have your pick of the litter when it comes to how long you can repay those loans.

What’s Cool:

- Rates that won’t hurt your wallet

- Rate cuts for the lucky ones

- Fewer term options

| Feature | Detail |

|---|---|

| Minimum Loan Amount | $5,000 |

| Maximum Loan Amount | $100,000 |

| APR | 5.49% – 11.49% |

| Loan Term | 36 – 60 months |

Harley-Davidson Financing

Did you get your heart set on a Harley? Harley-Davidson Financing is tailored just for those iconic bikes, making it a breeze for new models. Score low interest rates and stretch those repayment terms a bit, with financing set up straight at the dealership.

What’s Cool:

- Perfect for Harley lovers

- Low rates could make you smile

- Flexible payback times

- Sorted right at the dealership

| Feature | Detail |

|---|---|

| Minimum Loan Amount | Varies by dealership |

| Maximum Loan Amount | Varies by dealership |

| APR | 3.99% – 8.99% |

| Loan Term | 36 – 84 months |

Picking the right loan comes down to a mix of interest rates, how long you’ll be paying it back, and who’s got the best reputation. Need even more know-how on bikes? Check out our guides on how to test ride a bike, new vs used bike, and the lowdown on bike warranties. Time to hit the road!

Obtaining a Motorcycle Loan

Trying to get a motorcycle loan? It might sound like a big deal, but understanding what the folks with the money want can make the whole thing much less of a headache.

Credit Score Requirements

Your credit score is basically the key to unlocking a decent loan rate. There’s no hard and fast rule about the minimum score you need, but the higher your score, the better your chances of snagging a sweet deal.

| Credit Score Range | Loan Impact |

|---|---|

| 750 – 850 | Awesome rates and terms |

| 700 – 749 | Pretty good rates |

| 650 – 699 | Just okay rates |

| 600 – 649 | Not-so-great rates |

| 500 – 599 | Rough rates |

If you wanna keep your credit in the good books, pay those bills on time, trim down your debts, and keep an eye on your credit report for any sneaky surprises.

Documentation Needed

When you’re asking for a loan, lenders like to see some paperwork. Here’s the stuff you’ll probably need to bring along:

- Proof of Employment: This could be your pay stubs or anything official from your workplace.

- Proof of Residence: Typically, stuff like utility bills or a lease agreement.

- Identification: Your driver’s license or state ID will do just fine.

- Credit History: They want to eyeball your credit score and history.

- Down Payment Proof: Bank statements or money orders work here.

Having this paperwork ready before you even ask for a loan can make things go way smoother.

Application Process

Getting a motorcycle loan is a bit of a dance, but here’s the basic routine:

- Check Your Credit Score: Peek at your credit score, and if it’s looking a little sad, do what you can to cheer it up.

- Shop Around for Lenders: Hunt down who’s giving out motorcycle loans and compare their rates to see who’s offering the best deal. Check out some lender options.

- Get Pre-approved: Some lenders do pre-approvals—this lets you know how much you can borrow and what the interest looks like.

- Apply: Fill out the loan application with your favorite lender and hand over all the necessary documents.

- Go Over the Loan Offer: Look at the loan’s fine print, including interest rates, repayment terms, and any extra costs.

- Sign the Papers: Once you’re happy with the deal, go ahead and sign the loan agreement.

Knowing the drill can make snagging motorcycle financing less of a wild ride. And don’t forget to check out our section on Managing Fees and Additional Costs for other things like dealer costs and taxes that you might run into.

Tips for Securing Motorcycle Financing

Recommended Down Payments

So, you’re thinking of financing that shiny new ride? A bit of cash upfront can really make a difference. Aim for at least 10% down, but if you can swing it, 20% is even better. This not only gives you lower monthly payments, but it also keeps the loan balance in check, helping you dodge the dreaded underwater loan trap when your bike starts losing value.

| Down Payment Percentage | Benefits |

|---|---|

| 10% | Minimally good rates, but nothing to write home about |

| 20% | Friendlier monthly payments keep the loan principal lean, and prevent a loan nightmare |

Choosing Repayment Terms

Loan terms: they’re the real deal-breaker. How you choose to pay back the loan can hit your wallet pretty hard or barely at all. Short terms mean you say goodbye to interest bills faster, but they make for beefy monthly payments. Longer terms? They’re kinder month to month, but like a slow cook, they simmer up more total interest.

| Repayment Term | Pros | Cons |

|---|---|---|

| Short-term | Low interest, quicker closing | Big monthly bite |

| Long-term | Monthly relief | Total interest sneaks up on you |

Different lenders, different terms – it pays to shop around. Take a peek at how Digital Federal Credit Union stacks up; they’re known for competitive rates but might not give you all the wiggle room you crave.

Evaluating Lenders

Finding Mr. (or Mrs.) Right in the loan world? It’s key to scoring a sweet deal. Keep an eye on:

- Interest Rates: Don’t just glance at the numbers. Scrutinize the annual percentage rates (APR) from different lenders. They’re shaped by market whims, payback schedules, and even your own credit swagger.

- Credit Score Requirements: Can’t brag about your credit score? Some lenders are still your friend. Southeast Financial works with a bunch of partners and doesn’t mind if you’re scoring as low as 575.

- Loan Amounts and Terms: Make sure your lender can handle your needs and offers terms that fit your lifestyle. Check out platforms like LendingTree, which hooks you up with a suite of lender options tailored to your credit game.

Scour the reviews, and do a background check on their street cred. Sites like Investopedia dig deep into lender reps, so lean on them for the lowdown.

Ready to roll on your new set of wheels? We’ve got heaps more in our bike brands comparison and compare bike specs pages. Plus, getting your head around the bike ownership cost might help you from wrecking the bank. Happy riding!

Special Considerations for Motorcycle Loans

Dipping your toes into the world of motorcycle loans? There’s a lot to mull over, so let’s break it down. You’ll want to know your options and find the right fit for your wallet and riding dreams. Below, we hash out the differences between getting financing straight from a dealership versus shooting for loans online or good old regular banks.

Financing from Dealerships

Going straight to a dealer might just feel right for you—easy-peasy and not too messy. If you’re eyeing that shiny new Harley-Davidson, they’ve got their own financing gigs going on. These plans often come with perks, like sweet low rates on new sets of wheels and payback terms that you won’t need a PhD to understand. The catch? You’re usually stuck with buying just their brand. So that means cruising to a Harley dealer or finding some dude selling a pre-loved one.

The good stuff about dealership financing:

- Easy Shopping: Buy and borrow in one spot.

- Promos Galore: Scoop up deals at low rates during special sales.

- Friendly Terms: Payback options that bend to your schedule.

The downsides? Well…

- Stick to the Brand: You’re tied to their brand and selections.

- Might Pay More: Rates might sometimes edge out higher than banks or credit unions.

Want to get into the nitty-gritty on Harley and other bike money matters? Spin your wheels over to our detailed bike financing guide.

Online Lenders vs. Traditional Banks

When snagging that motorcycle loan, you’ve got the digital crew—online lenders—and the trusty standby—traditional banks. Each comes with its own set of perks and quirks.

Online Lenders

- Wallet-Friendly Rates: With less overhead, they often toss you better interest deals.

- Speedy Gonzalez Approvals: Apps are quick—sometimes they give you a nod instantly.

- Stay Comfy: Handle all the paperwork from your couch.

Traditional Banks

- Old-School Trust: They’ve been around, so you might sleep better at night.

- Personal Touch: Some things just need a face—not a computer screen.

- Bundle Up: You might sweeten the pot by pairing up with your accounts for better rates.

| Feature | Online Lenders | Traditional Banks |

|---|---|---|

| Interest Rates | Usually lower | Sometimes higher but can vary |

| Time to Approve | Instant or within a day | Might be a few days |

| App Process | Fully done online | Could involve several steps or visits |

| Service Style | Virtual help | In-the-flesh support |

The choice between these two might come down to how you like to handle your money—fast and digital, or with some old-school charm. Wanna snag more details? Check out our article on where to buy bikes.

Picking up these nuggets of wisdom can seriously help when you’re looking to fund your two-wheeled adventures. Weighing up the perks and pitfalls of dealership deals and comparing online lenders to your neighborhood bank can steer you in the right direction.

Wanna keep the wheels rolling with more tips on bike stuff? Dive into our other reads on bike frame sizing, new vs used bikes, and negotiate bike price.

Managing Fees and Additional Costs

Buying a motorcycle isn’t as simple as handing over a wad of cash for the price sticker on the handlebar. Surprise, surprise! Extra charges—taxes, dealer shenanigans, and paperwork abound—mean the showroom price isn’t what you’ll end up forking over. Let’s unpack dealer fees and the red tape that swells your final payout.

Understanding Dealer Fees

Dealer fees are like hidden gremlins; they sneak costs into that motorcycle purchase. These sneaky charges can range from a mere $200 to a gut-punching $2,000 on top of your bike’s price. Here’s the rundown:

- Documentation Fees: Somebody’s got to shuffle those papers and, guess what? You’re paying for it. The price of this task? Anywhere from $100 to a steep $500, depending on where you’re buying that hot rod, err, motorcycle.

- Freight Fees: Ever thought about how your shiny new bike got from the factory to the dealership? Those logistics aren’t free—expect to shell out some dough for it.

- Setup Fees: A brand-new bike isn’t ride-ready fresh off the truck. Initial inspection and fine-tuning are necessary—and yes, you’re footing the bill.

Check the typical dealer fees chart:

| Fee Type | Range |

|---|---|

| Documentation | $100 – $500 |

| Freight | $200 – $500 |

| Setup | $50 – $300 |

Hagglers, rejoice! For some negotiation tips, hop over to our guide on how to negotiate bike prices.

Tax, Title, and License Fees

Wait, don’t close that wallet just yet! Uncle Sam wants a piece, too. This batch of fees, necessary thanks to our friendly neighborhood government, varies by your state’s rules and can pack a punch.

- Sales Tax: Your beat on two wheels isn’t free from this state-mandated hand-in-your-pocket.

- Title Fees: Want that shiny ownership paper in your name? That’ll cost ya.

- License Fees: Don’t forget your plate—driving sans one is a definite no-no.

The cost can wildly vary depending on where you live. Here’s a glimpse at state fee variations:

| State | Sales Tax | Title Fee | License Fee |

|---|---|---|---|

| California | 7.25% | $15 | $46 |

| Texas | 6.25% | $33 | $51.75 |

| New York | 4% | $50 | $25 |

Curious about local hoops to jump through for registration? Pedal on over to our bike registration guide.

Rolling up all these costs into your budget is not just smart, it’s necessary to keep surprises at bay when buying your bike. Doing your homework will ensure you cruise the open road and laugh off those surprise charges popping up like unwanted exes. Keep your bike ownership cost in check and ride on!

Improving Credit for Better Loan Offers

Thinking about a new motorcycle? Sprucing up your credit score can be your ticket to sweeter loan deals. Here’s the scoop.

Credit Improvement Steps

When you polish that credit score, lenders will start tossing better loan offers your way like they’re going out of style. Here’s how to get started:

- Peek at Your Credit Reports:

Keep tabs on your credit reports from all three major bureaus. Catch those pesky errors before they mess with your financial mojo. - Bill on Time, Every Time:

Paying bills promptly paints a pretty picture of reliability, and credit scores love it! - Trim That Debt:

Whittling down those credit card balances helps give your credit utilization a friendly nudge in the right direction. - Experian Boost®:

This handy free tool from Experian adds your utility and telecom bill payments into the credit mix. It might just give your score a little lift.

Impact of Credit Score on APR

Consider the Annual Percentage Rate (APR) on your motorcycle loan. It’s like a seesaw with your credit score—when one goes up, the other comes down. High scores usually mean low APR, which keeps your loan costs in check. Other bits like market trends, loan duration, and payment plans also play a part.

| Credit Score Range | Estimated APR |

|---|---|

| 750 – 850 | 4.5% – 6.5% |

| 700 – 749 | 6.5% – 8.5% |

| 650 – 699 | 8.5% – 12% |

| 600 – 649 | 12% – 15% |

| Below 600 | 15%+ |

Rocking a high credit score? You’re usually in line for lower interest rates. That translates to better bike financing deals, smaller monthly payments, and lighter total loan expenses.

Ready to explore more about getting that dream bike without emptying your wallet? Check out our handy guides on bike price guide and where to buy bikes. They’re packed with tips to help you make smart choices before you hit the open road.

Calculating Affordability

Gearing up for a new motorcycle? Whether it’s your first ride or you’re a seasoned biker, sorting out the cash bit is crucial. Let’s take a crack at understanding how to finance that shiny two-wheeler without breaking the bank.

Using Loan Calculators

Ever wondered how much bike bling your wallet can handle? Loan calculators are your new BFF. Pop in some numbers like your down payment, loan term, and interest rate, and they’ll do the math magic for you.

Say you’ve got $1,000 set aside for the down payment, plan to pay it off over 48 months, and snag a 6% interest deal. Toss these numbers into the motorcycle loan calculator by J.D. Power, and boom—you’ll know what you’re looking at for monthly payments.

| Input Details | Example Values |

|---|---|

| Down Payment | $1,000 |

| Loan Term | 48 months |

| Interest Rate | 6% |

| Loan Amount | $9,000 |

| APR | 6.5% |

This isn’t just number crunching; it’s your roadmap to budget bliss. Keep in mind, though, that loan offers can dance around depending on your credit score and what’s happening in your neighborhood bank.

Considering Monthly Payments

Monthly payments aren’t just a number. They’re like your bike’s fuel—essential. Besides the principal and interest, don’t forget those sneaky extras like taxes and dealer fees.

| Loan Amount | Interest Rate | Loan Term | Monthly Payment |

|---|---|---|---|

| $9,000 | 6% | 48 months | $211 |

| $9,000 | 6% | 60 months | $174 |

| $9,000 | 6.5% | 48 months | $213 |

| $9,000 | 6.5% | 60 months | $176 |

Want to play around with what your payment could look like? Use a loan calculator and tinker with the loan term or interest rate till you find that sweet spot—ideally, a payment that’s less than 15% of your monthly income. This trick helps keep the financial stress levels in check.

Don’t forget the rest of the equation, though. Owning a bike means shelling out cash on maintenance, insurance, and regular TLC. For a more detailed look into these costs, swing by our bike ownership cost guide.

With all this savvy info in your pocket, you’re set to breeze through the financing process, ensuring your ride is as smooth as your wallet’s ride. If you’re still hungry for tips, our guides on negotiating bike prices and financing from dealerships can fill in the gaps. Ride on!

Conclusion

Financing your motorcycle is a pivotal step toward turning your riding dreams into reality. By understanding the various loan types, from secured to unsecured, you can make informed decisions that align with your financial capabilities.

Remember, your credit score plays a significant role in determining the interest rates and loan amounts you qualify for, so taking steps to improve it can lead to substantial savings. Additionally, being aware of the hidden fees and additional costs ensures that there are no unpleasant surprises down the road.

Choosing the right lender, whether it’s a credit union, traditional bank, or online lender, requires careful consideration of their terms, rates, and reputation. Don’t hesitate to shop around and compare offers to find the best fit for your needs.

Utilizing tools like loan calculators can help you visualize your monthly payments and overall affordability, ensuring that your new motorcycle enhances your life without straining your finances.

Ultimately, mastering motorcycle financing is about balancing your passion for riding with smart financial planning. With the insights and tips provided in this guide, you’re well-equipped to navigate the financing landscape confidently.

Whether you’re purchasing your first bike or upgrading to a new model, making informed financial choices will keep you cruising smoothly on the road ahead. Happy riding!

FAQs

What is the difference between secured and unsecured motorcycle loans?

Secured loans require collateral, typically your motorcycle, resulting in lower interest rates. Unsecured loans don’t require collateral but come with higher interest rates and fees.

How does my credit score affect my motorcycle loan?

A higher credit score can qualify you for lower interest rates and larger loan amounts, while a lower score may limit your options and increase costs.

What documents are needed to apply for a motorcycle loan?

You’ll need proof of employment, proof of residence, identification, credit history, and down payment proof such as bank statements or money orders.

Can I get a motorcycle loan with bad credit?

Yes, lenders like Southeast Financial work with lower credit scores (starting at 575), though you may face higher interest rates and fees.

Is it better to finance through a dealership or a bank?

Financing through a dealership offers convenience and potential promotional rates, but banks and credit unions often provide better interest rates and terms. It’s best to compare all options before deciding.

Final Thoughts

Financing a motorcycle is more than just securing a loan; it’s about making a strategic investment in your passion for riding. By understanding the various financing options, improving your credit score, and being aware of all associated costs, you empower yourself to make decisions that best suit your financial landscape.

Remember, the journey to owning your dream bike starts with informed choices and careful planning. Utilize the resources and tips provided in this guide to navigate the financing process with confidence. Whether you’re gearing up for your first ride or looking to upgrade, the right financing strategy ensures that your adventure on two wheels is both thrilling and financially sustainable.

Stay informed, ride safely, and enjoy the open road with peace of mind knowing you’ve made the best financial decisions for your motorcycle purchase.

Key Tips

- Boost Your Credit Score: Pay bills on time, reduce existing debt, and regularly check your credit report for inaccuracies.

- Save for a Larger Down Payment: A higher down payment can lower your monthly payments and reduce the total interest paid.

- Compare Multiple Lenders: Don’t settle for the first offer. Shop around to find the best interest rates and loan terms.

- Understand the Total Cost: Factor in all additional fees, taxes, and insurance when calculating your budget.

- Use Loan Calculators: These tools help you estimate monthly payments and determine what loan amount fits your financial situation.

- Read the Fine Print: Always review loan agreements carefully to understand all terms and conditions before signing.

- Consider Loan Terms Carefully: Shorter terms mean higher monthly payments but less interest, while longer terms offer lower payments but more interest over time.

Recommended Biking Products and Accessories

- Motorcycle Helmet:

Shoei RF-1400 – Renowned for safety and comfort, essential for every rider. - Protective Riding Gear:

Dainese Carbon D3 Helmet and Jacket – Combines style with top-tier protection. - Motorcycle Loan Calculator:

Auto Approve Motorcycle Loan Calculator – Helps you estimate monthly payments and affordability. - Motorcycle Maintenance Kit:

Michelin Motorcycle Maintenance Kit – Includes essential tools for keeping your bike in top condition. - Bluetooth Motorcycle Helmet Communication System:

Sena SMH10 – Stay connected on the road with clear communication features. - Motorcycle Insurance:

Progressive Motorcycle Insurance – Offers competitive rates and comprehensive coverage options. - Motorcycle Locks and Security:

Abus Granit Steel 540 – High-security lock to protect your investment. - Ride-Comfort Accessories:

Touratech Flex Tank – Enhance your bike’s comfort and storage capacity for long rides. - Helmet Cameras:

GoPro HERO11 Black – Capture your adventures and rides with high-quality video footage. - Motorcycle GPS Navigation:

Garmin Zumo 396 LMT-S – Durable and bike-specific GPS for seamless navigation.